Your donations help us to continue serving Maricopa County’s abandoned, neglected and abused children. Arizonans for Children is a 501 (c) 3 charitable organization and relies solely upon the generosity and commitment of community members to provide critical services to foster youth; and we gratefully accept your tax-deductible financial and in-kind donations in support of our programs or operating expenses. Use the links below to donate online, via mail, or a phone call!

- Mail Your Donation using this form

- Click below to donate online:

Donate your Tax Credit with the PayPal Giving Fund. PayPal pays all the fees. $1,234 for married couples and $618 for single

Tax Credits

Receive a dollar-for-dollar tax credit against your state tax liability. New tax credit limits have been introduced for tax year 2025 allowing $1,234 for married couples and $618 for single filers. The tax credit is claimed on Form 352. Arizonans for Children’s QFCO code is 10025.

You can claim donations made through April 15, 2026 on your 2025 Arizona income tax return.

The Arizona Foster Care Tax Credit can be claimed in addition to the Arizona Charitable Tax Credit and the Arizona Public Schools Tax Credit and if the full amount isn’t used, you can carry it over. You do not need to itemize deductions to claim this Arizona tax credit. We put 100% of your donation towards children’s programs, we do not use this funds for administration or fundraising.

See Tax Credit FAQ’s

If you need ideas or want to make a personal donation, you can check out our Amazon wish list at https://a.co/8HIR4eq

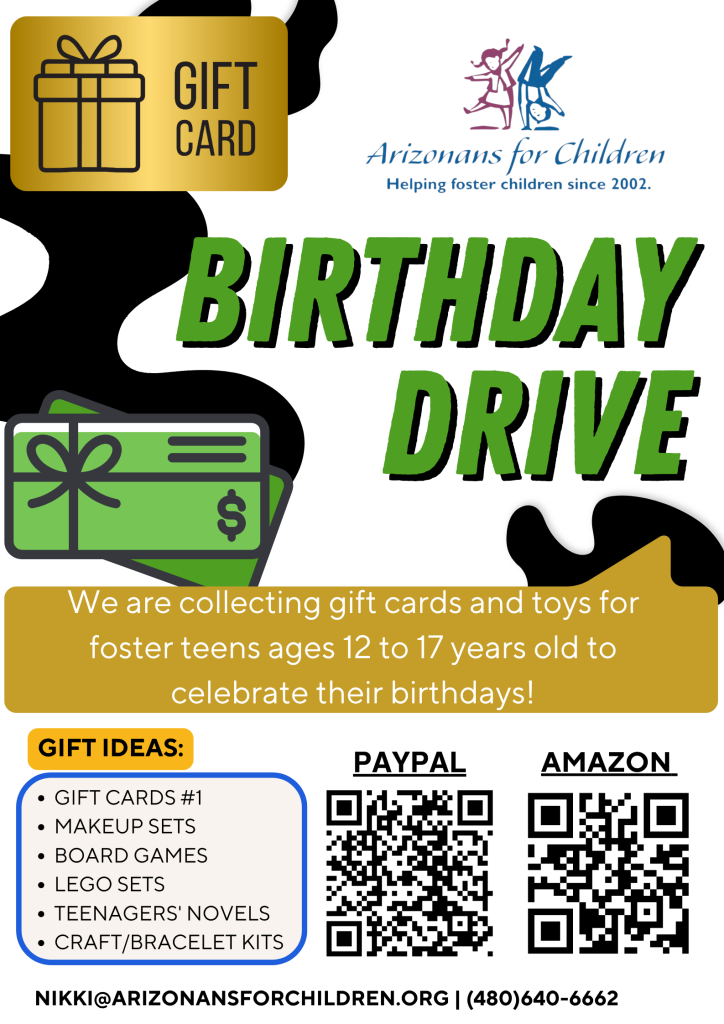

Birthday Drive

We are excited to have the opportunity to celebrate foster children throughout Maricopa County on their birthday! We have a birthday program that provides the children with a couple of gifts that they get to open on their birthday. For teens, they are a little pickier so we send them gift cards to go shopping on their own. Birthdays should be treated as something special and not an inconvenience as each child may not have family to celebrate with. Every life is precious.

We are collecting gift cards and toys for foster teens ages 12 to 17 years old to celebrate their birthdays!

Gift Ideas:

• Gift Cards #1

• Makeup sets

• Board Games

• Lego Sets

• Teenagers’ Novels

• Craft/Bracelet Kits

We give birthday presents to foster children around Maricopa County. This wouldn’t be possible without the kind donations of people who want to support the children in different ways. Thank you for helping us make their birthdays special and fun!

Donate some funds with Paypal or shop our Amazon Wishlist to have the items sent directly to us.

Donations to Arizonans for Children qualify for the QFCO tax credit. If you need ideas on what to buy, you can shop on our Amazon wish list for convenience. If you prefer to drop off the gifts, please mark them for the birthday program and deliver it to one of our Visitation Center locations below. For any questions, pease contact Nikki Robinson at (480) 640-6662.

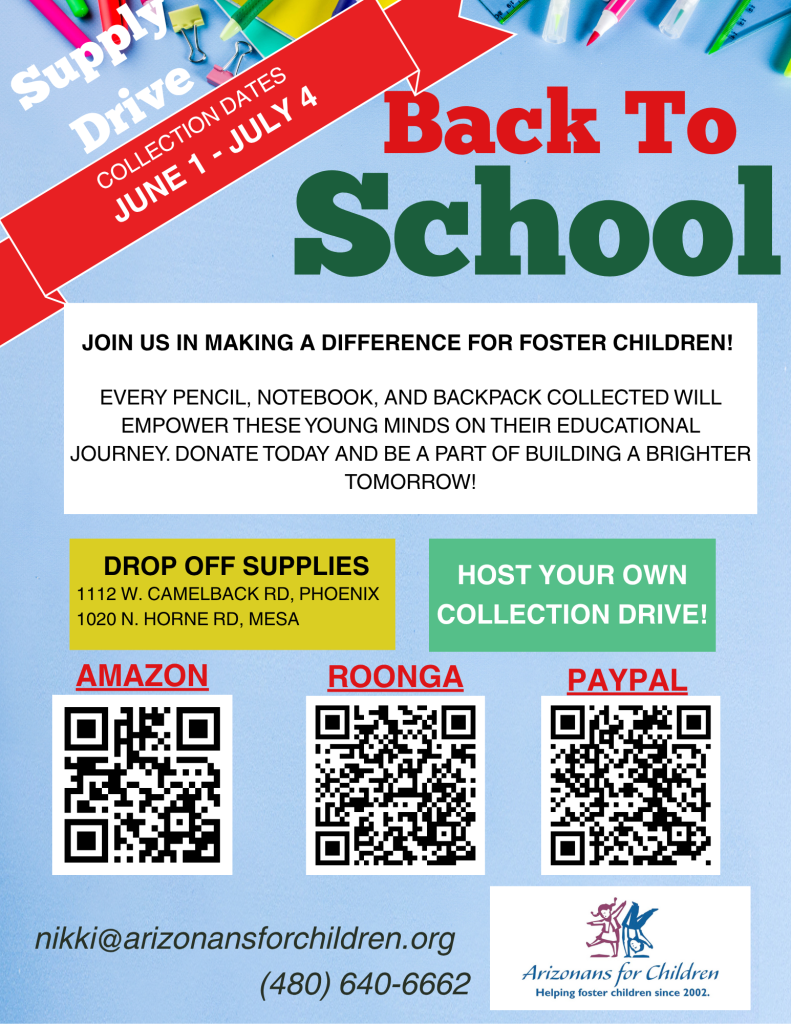

Back To School Drive

Matching Gifts Program

Numerous companies offer employees a matching gift program that increases a financial gift to Arizonans for Children. Prior to making your gift, check here to see if your employer has a matching gift program.

Share a Special Occasion

Celebrate your special occasion or milestone event by helping Arizona’s most vulnerable children and families. Ask your friends and family members to make a donation to Arizonans for Children in your honor, to join you in collecting items for an in-kind donation drive, or to make a donation through your Facebook Fundraiser.

Hygiene Drive

Are you looking for an easy way to make a difference? Consider hosting a hygiene drive and making a positive impact on the lives of these deserving children. Your efforts can bring smiles and hope to so many! Click here to download a flyer for printing or sharing.

Wish List

Donations are always appreciated to help our centers function! You can click here to view our Amazon Wish List.

Ebay for Charity

Do you sell on Ebay? You can promote our organization and collect funds on the items you sell. Click this link to find out more: https://www.charity.ebay.com/charity/i/Arizonans-for-Children/346791

In Kind Donations

Does your organization offer a service or program that could benefit at-risk children? AFC warmly welcomes any new opportunity to expand our existing service network, and we actively cultivate partnerships with other community organizations to ensure best practices. Please contact us today for more information.

Annual Holiday Party Donations

Every year, Arizonans for Children hosts a huge Christmas party for children in foster care. We need *new* presents to give these children. These gifts can be donated any time throughout the year and you can view our Holiday Wish List here. Gifts can be dropped off or delivered to one of our visitation centers.

Visitation Center Donations

Donations are greatly appreciated to help our centers. Cleaning supplies, food, and art supplies are a few examples of items that help our centers run smoothly! You can view our Center Wish List here

Gifts can be dropped off or delivered to one of our visitation centers.

Our Locations:

Downtown Phoenix Center

1112 West Camelback Road Phoenix, AZ 85013

Opening Hours:

Monday-Friday 9-6

Saturday 10-2

No Sunday Hours

East Valley Center

in the Desert Heritage Church

1020 N Horne, Mesa, Arizona 85203

Opening Hours:

Monday-Friday 10-6

No Saturday or Sunday Hours

Your donations help us to continue serving Maricopa County’s abandoned, neglected and abused children.